How do beliefs about climate change impact coastal housing markets? In a world where everyone understands how future coastal flood risk will increase due to sea level rise, a well-functioning housing market will take this information into account. The price of coastal homes at risk from future sea level rise will be lower than equivalent homes not in harm’s way. However, continued evidence shows that there is significant variation in beliefs about climate change. While an estimated 72% of U.S. adults think global warming is happening in 2020, this number ranges from 49.9% in Lawrence County, Kentucky to 86.5% in San Francisco County, California. What impact will this belief variation, or heterogeneity, have on coastal housing markets? Economic theory warns that these houses could be overpriced relative to their true fundamental value if everyone was well informed. My coauthor, Lint Barrage, and I estimate this potential overvaluation in a new paper recently accepted at the Review of Financial Studies.

In the paper, we first build a theoretical housing market model where individuals have heterogeneous beliefs about future flood risk, with some fully attentive to the increasing threats and other who are overly optimistic, underestimating future flood risk. The model highlights that several factors can impact the price trajectories of coastal houses, including the severity of the flood risk, the amenity value people receive from living by the coast, and individuals’ expectations of how prices will change in the future.

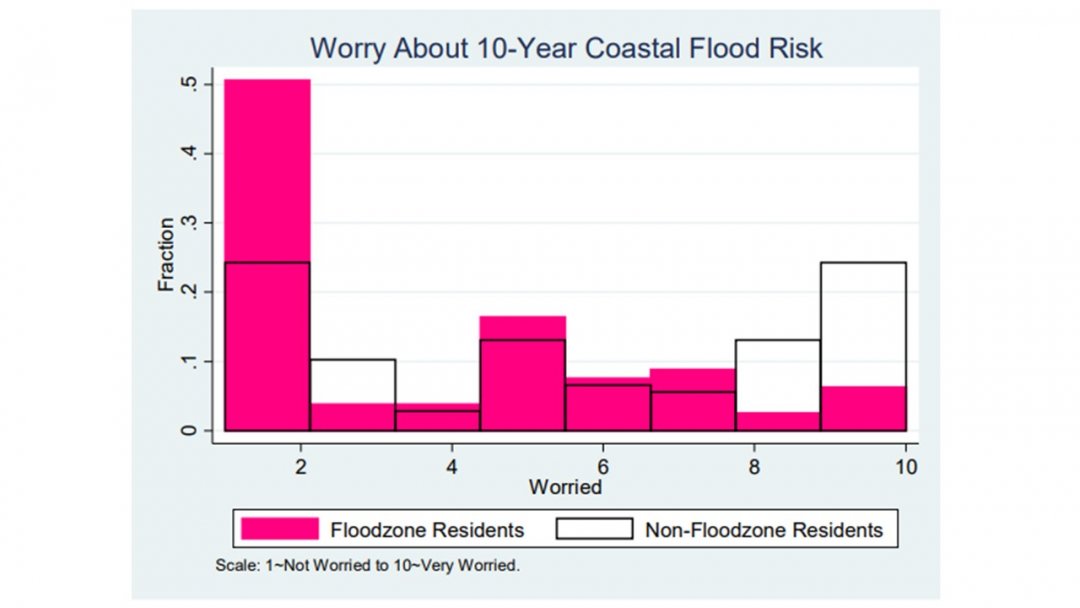

Second, in order to estimate a solution to the model, we collected real world data for model calibration, including from a door-to-door survey we conducted in Rhode Island. We elicit a variety of information in the survey, including respondents’ amenity values for coastal living, their flood risk perceptions, and their beliefs about future flood risk. As anticipated, people who live nearby the coast are more likely to enjoy living by the coast. However, when asked about flood risk, almost 70% of coastal residents underestimated the flood risk for their specific homes. In addition, when asked on a 1 to 10 scale about how worried they were about the risk of a coastal flood in the next 10 years, high flood risk coastal residents (distribution in pink in the figure below) were significantly less worried about the risk of a coastal flood than low flood risk inland residents (distribution in white in the figure below).

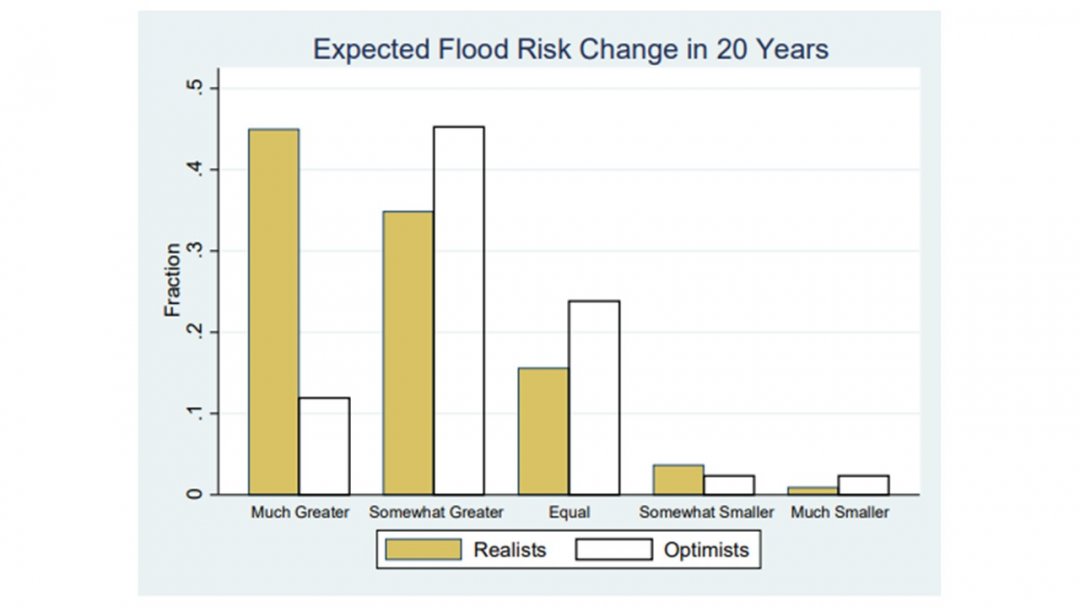

Finally, while a majority of respondents expected future coastal flood risk to increase, those who more accurately estimate current flood risk (those we called “realists,” in gold in the figure below) expected significantly more future flood risk than those who underestimate current risk (those we called “optimists,” in white in the figure below).

Lastly, we estimated the impact of this belief heterogeneity on the price of coastal homes. We estimate that current prices exceed the rational fundamental price of homes by 13%. We also find that as the market learns over time, either through continued experience with bad flood events or policy reforms (such as a mandatory insurance requirement with premiums priced to reflect true flood risk), this housing price bubble will deflate over time, leading to increased price volatility in these markets. Are the results for Rhode Island indicative of other coastal communities? In extended results, we apply our model to other coastal markets across Massachusetts, North and South Carolina, Florida, and Texas and find larger price bubbles across many of these markets relative to Rhode Island. These findings have important implications for policy, including for the future stability of housing and mortgage markets as well as flood insurance reform. Only time will tell how prices in coastal housing markets will ultimately evolve but our work highlights the likelihood of future price volatility in years and decades to come as people learn more about climate change.